philadelphia property tax rate calculator

100000 60000. 100000 30000.

The calculator is available at propertyphilagov.

. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. Please read the following terms of use carefully before using this web site. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA.

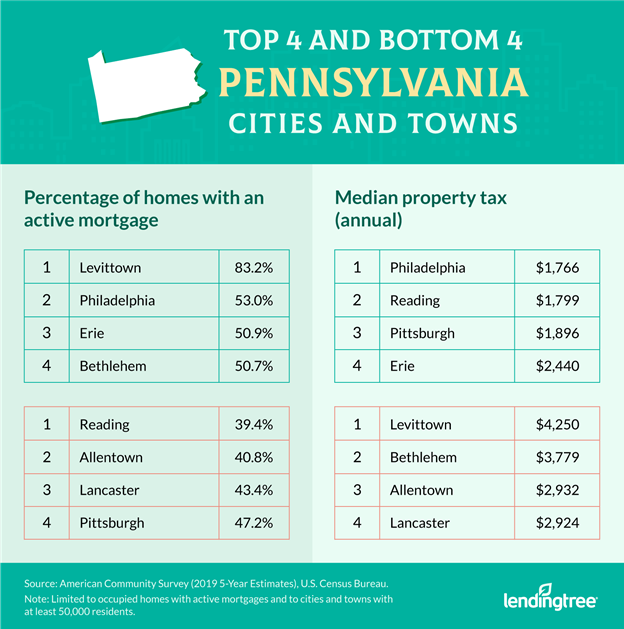

The average effective property tax rate in Pennsylvania is 150 but that varies greatly depending on where you live. In Philadelphia County for example the average rate is 099. It was launched soon after the Office of Property Assessment OPA released new assessments for over 580000 Philly properties.

Related

- end up synonym informal

- life cycle of a seed for kindergarten

- baton rouge country club scorecard

- gucci secaucus new jersey

- hotels in miramar florida 33027

- southern kentucky truck sales

- corpse bride wedding vows in spanish

- willowbrook state hospital original video

- chinese food white plains rd trumbull ct

- city parks with basketball courts near me

Pennsylvania Property Tax. Tax rate for nonresidents who work in Philadelphia. Proper notice of any levy increase is also a requirement.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Philadelphia County Tax Appraisers office. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your. Unsure Of The Value Of Your Property.

It also provides for an easier to understand tax system by removing complicated fractions when calculating tax bills. Ad Find Philadelphia County Online Property Taxes Info From 2022. Automate Lodging Taxes With MyLodgeTax.

For comparison the median home value in Philadelphia County is 13520000. Its release comes one month after new assessments were mailed to many property owners in Philadelphia those whose assessments were unchanged did not receive a mailing. What is the most recent assessed value of your property.

TAX RATE MILLS ASSESSMENT PROPERTY TAX. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Philadelphia County Property Taxes Range.

A composite rate will. Philadelphia determines tax rates all within the states regulatory rules. These rates are based on the median annual tax payment as a percentage of median home value.

The Actual Value Initiative or AVI is a program for re-evaluating all properties in the city to ensure that values are fair and accurate. Estimate Your Property Tax. Choose options to pay find out about payment agreements or print a payment coupon.

Review the tax balance chart to find the amount owed. 1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania.

Ad Lodging Tax Doesnt Have to Be Complicated. If you need to find out the exact property tax owed on any property you can contact the local property tax assessor for the. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

The Real Estate Tax estimator is available on the propertyphilagov website. Based on latest data from the US Census Bureau. You can also generate address listings near a property or within an area of interest.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. This calculator does not include homestead exemptions. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Your actual property tax burden will depend on the details and features of each individual property. Use the Property App to get information about a propertys ownership sales history value and physical characteristics. In Allegheny County the rate is 201.

After users type in their property address theyll be taken to a page with complete details of the property. Once market values are established your city along with other county public units will calculate tax levies independently. When totalled the property tax load all taxpayers carry is recorded.

You can use this application to estimate your real estate tax under the Actual Value Initiative AVI. Enter the zip code in which the property is located to estimate your property tax. The countys average effective property tax rate is 212.

To find and pay property taxes. Taxation of properties must. Average Property Tax Rate in Philadelphia County.

Realty Transfer Tax Requirements and rates related to the Realty Transfer Tax which applies to the sale or transfer of real estate located in Philadelphia. Use Philadelphia Forwards Real Estate Tax calculator to see how the reassessment and other polices could affect your home or property. That rate applied to a home worth 239600 the county median would result in an annual property tax bill of 5075.

Estimate My Property Tax. Philadelphia County Property Taxes Range. Philadelphia as well as every other in-county public taxing entity can at this point calculate required tax rates as market value totals have been determined.

If you dont have your latest Philadelphia County Property Assessment Click Here. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances. The City of Philadelphia recently launched an online calculator to help residents estimate their 2023 property tax bills.

Find All The Record Information You Need Here. It is a free tax calculator provided by the Affinity Real Estate Team for estimation purposes only. Enter the address or 9-digit OPA property number.

Philadelphia Revenue Philarevenue Twitter

Transfer Tax Calculator 2022 For All 50 States

Mortgage Rates In Pennsylvania Plus Stats

216 Ripka St Philadelphia Pa 19127 Mls Paph2035870 Zillow

1614 Fontain St Philadelphia Pa 19121 Mls Paph2155208 Zillow

Philadelphia Revenue Philarevenue Twitter

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Payment Calculator Philadelphia Mortgage Brokers

1922 North St Philadelphia Pa 19130 Zillow

Philadelphia Revenue Philarevenue Twitter

Philadelphia Revenue Philarevenue Twitter

Consumer Price Index Philadelphia Camden Wilmington June 2022 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Philadelphia Revenue Philarevenue Twitter

8305 Ridgeway St Philadelphia Pa 19111 Realtor Com

2519 E Clearfield St Philadelphia Pa 19134 Mls Paph2130780 Zillow

1910 Green St Philadelphia Pa 19130 Mls Paph2134360 Zillow

Pennsylvania Property Tax H R Block

2232 Cross St Philadelphia Pa 19146 Mls Paph2132126 Trulia